XRP Price Prediction: Bullish Technicals and Fundamental Catalysts Point to Q4 Breakout

#XRP

- Technical Strength: Bullish MACD momentum and strong Bollinger Band support at $2.79 provide solid foundation for upward movement

- Fundamental Growth: 500% surge in on-chain activity and new mining integrations demonstrate expanding utility and adoption

- Catalyst Potential: Post-September rate cuts and potential ETF approval could drive prices toward $4+ targets in Q4 2025

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Continuation Signals

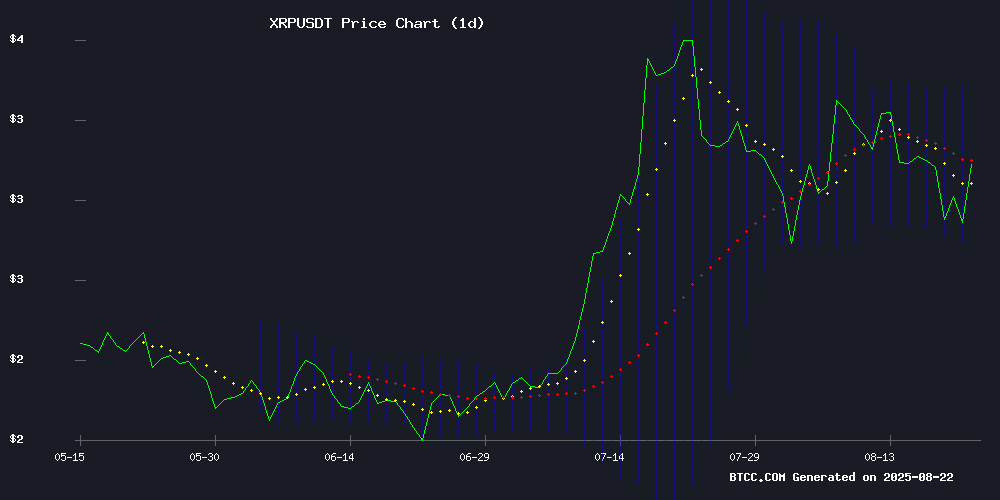

XRP is currently trading at $2.86, positioned below the 20-day moving average of $3.08, suggesting potential consolidation. The MACD indicator shows bullish momentum with a reading of 0.0732 above the signal line, while the Bollinger Bands indicate the price is approaching the lower band at $2.79, which could serve as strong support. According to BTCC financial analyst Ava, 'The technical setup suggests XRP is building a foundation for upward movement, with key resistance at the upper Bollinger Band of $3.37.'

Market Sentiment: Mixed Signals Amid Regulatory Developments

Recent news presents a complex picture for XRP. While Ripple's partnership with TRM Labs enhances security credibility, the SEC's ETF decision delays and $300 million investor sell-off create near-term pressure. However, positive developments including PlanMining's integration and explosive 500% on-chain activity growth indicate strong underlying demand. BTCC financial analyst Ava notes, 'The fundamental landscape shows both challenges and opportunities, with potential catalysts in Q4 that could drive prices toward the $4 target.'

Factors Influencing XRP's Price

Ripple Joins TRM Labs' Beacon Network to Combat Crypto Crime in Real-Time

Ripple has become a founding member of the Beacon network, an innovative system designed by TRM Labs to detect and prevent cryptocurrency theft as it occurs. The network monitors flagged addresses and tracks stolen funds across wallets and blockchains, issuing real-time alerts to exchanges and financial institutions when suspicious transactions approach cash-out points.

San Francisco-based Ripple stands alongside major platforms including OKX, Crypto.com, and Anchorage Digital as inaugural participants in the initiative. The collaboration marks a significant step toward automating the fight against crypto crime, with Beacon serving as an early warning system to freeze illicit assets before they exit the blockchain ecosystem.

Ripple Price Dips as Investors Cash Out $300M Ahead of Powell Speech

XRP fell 3% to $2.85 as traders locked in profits following hawkish FOMC minutes. The remittance token briefly touched $3 before retreating, with Santiment data showing $300M in realized gains. Market sentiment soured after Fed policymakers emphasized inflation concerns, raising expectations for a September rate pause.

Profit-taking accelerated across both short-term and long-term holders, mirroring broader crypto market caution. Technical charts suggest $2.78 may serve as critical support after rejection at the psychological $3 level. Exchange flow metrics from Coinglass corroborate the sell-off pressure.

XRP Eyes Potential Bullish Q4 Repeat as Key Levels Come Into Play

XRP appears to be following its historical Q4 pattern, consolidating after July's pullback and showing early signs of strength. The cryptocurrency's current behavior mirrors its late 2023 cycle, when it rallied 290% from a $0.50 base to nearly $2.80 before settling at $2 support.

On-chain data reveals significant profit-taking by long-term holders, with $375 million in realized gains recorded during July's peak at $3.55. This distribution pattern resembles January's setup that preceded a 60% surge, suggesting potential for another upward MOVE if $3 support holds.

The market now watches whether XRP can flip current levels into support for another breakout. Historical precedent shows the altcoin tends to rally after extended consolidation periods when long-term holders stop selling NEAR their cost basis.

XRP's Potential Surge to $4 Post-September Rate Cut

Ripple's XRP token recently reached a seven-year peak of $3.65 on July 18, only to retreat by over 20%. Current CoinGecko data shows an 11% weekly decline, yet a 387.7% surge since August 2024 hints at underlying strength. The Federal Reserve's anticipated 25-basis-point rate cut in September, now priced at 81.2% probability by CME's FedWatch tool, could reignite bullish momentum for risk assets like XRP.

Market sentiment remains fragile as the rate cut odds have slipped from 96% to 81% ahead of the Jackson Hole meeting. XRP's liberation from its SEC lawsuit earlier this month removes a critical overhang, potentially clearing the path for new all-time highs should macro conditions align. The token's 0.7% daily gain amidst broader declines suggests accumulating investor interest.

XRP's 970% Surge Over Five Years: A $500 Investment Then Would Be Worth $5,350 Today

XRP, the third-largest cryptocurrency by market cap, has surged approximately 50% in the last two months, reigniting investor interest. The coin, now hovering just below $3, has seen a staggering 970% increase since August 2020 when it traded at $0.30. A $500 investment back then WOULD now be valued at $5,350.

Designed to address inefficiencies in legacy banking, particularly cross-border transactions, XRP promises faster and cheaper payments. Proponents argue that broader adoption by financial institutions will drive demand and price appreciation. However, misconceptions persist—many banks utilize XRP's underlying blockchain technology without directly interacting with the token itself, potentially decoupling its price from adoption trends.

The rise of stablecoins further complicates XRP's value proposition, as they offer similar benefits with reduced volatility. While the recent rally captivates speculators, the long-term trajectory hinges on tangible utility beyond speculative trading.

XRP On-Chain Activity Explodes By 500%, What’s Going On?

The XRP Ledger has recorded an unprecedented surge in transactional activity, with payment volumes between accounts skyrocketing 500% in a single day. On August 18, 2025, the network processed 844.5 million XRP tokens—dwarfing the previous day's 159.7 million and marking one of the most significant spikes this year.

Historical patterns suggest such explosive on-chain movement often precedes major price action, yet XRP's valuation remains stagnant despite the metric. The ledger's July 21 peak of 1.41 billion payments still holds the annual record, but August's resurgence signals renewed network demand. Market participants are scrutinizing whether this reflects institutional accumulation, retail FOMO, or whale repositioning.

PlanMining Integrates XRP for Cloud Mining, Offering Daily Earnings up to $7,700

PlanMining, a leading cloud mining platform, has added XRP as a primary payment settlement asset, providing a new passive income stream for cryptocurrency holders. The move comes as investors increasingly seek stable returns amid market volatility and inflationary pressures in traditional finance.

XRP's fast transaction speeds and low fees—long favored for cross-border settlements—now extend to cloud mining operations. Users can participate with minimal equipment, bypassing the need for expensive hardware while earning daily yields. PlanMining emphasizes its use of clean energy sources across mining facilities, aligning with growing environmental concerns in the sector.

XRP Holds Support Amid Whale Selling as Technicals Hint at Bullish Continuation

Ripple's XRP has weathered an 11% weekly decline, stabilizing at $2.90 after recovering from a $2.82 dip. The asset demonstrates resilience despite over 470 million XRP moving to exchanges in whale transactions.

Technical charts reveal a rectangular consolidation pattern following XRP's earlier breakout. GalaxyBTC notes this formation typically precedes continuation moves in the direction of the prevailing trend. Trading volume dipped 5% to $6 billion as markets digested recent price action.

The cryptocurrency maintains its trading range, with buyers emerging at lower levels even as large holders take profits. Market structure suggests accumulation may be occurring beneath the surface.

SEC Delays XRP ETF Decisions, Market Expert Predicts Imminent Approval

The U.S. Securities and Exchange Commission has postponed its decision on multiple spot XRP exchange-traded fund applications, pushing deadlines into October. Nate Geraci, President of The ETF Store, interprets the delay as a regulatory formality rather than a setback, suggesting approval could come within 60 days.

Key filings from 21Shares, Grayscale, Bitwise, and other major firms now face a compressed decision timeline in mid-to-late October. The SEC's systematic approach mirrors its handling of previous cryptocurrency ETF applications, with all rulings expected to follow consistent evaluation criteria.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency is demonstrating strong technical support levels while benefiting from growing institutional adoption and real-world utility through partnerships like TRM Labs and PlanMining integration.

Key investment considerations:

| Factor | Current Status | Impact |

|---|---|---|

| Price Position | $2.86 (Below 20-day MA) | Neutral to slightly bearish short-term |

| MACD Signal | Bullish (0.0732 > 0.0175) | Positive momentum building |

| Bollinger Bands | Approaching lower band ($2.79) | Strong support level identified |

| On-chain Activity | 500% increase | Very positive network growth |

| Regulatory Status | ETF delays ongoing | Temporary headwind |

While short-term volatility may persist due to regulatory developments, the combination of technical strength and fundamental growth drivers suggests XRP could reach $4+ levels post-September rate cuts, making it a solid investment for those with a medium to long-term horizon.